This is the final post in a series about a study on the post-pandemic travel patterns of remote tech workers. See the original research proposal, a set of early findings, or the deeper statistical analysis that led to these takeaways and conclusions.

You could also just watch a 3-minute condensed presentation of all of this, which was a top-10 finalist in a university-wide “Grad Slam” competition. This version was specifically designed for non-technical audiences!

Special thanks to my colleagues Kevin Fang and T. William Lester for their help in shaping this research!

To recap, five key insights were derived from regression-based analyses on the survey data:

- Office (commute) trips will be primarily employer-driven

- Commute length determines transport mode choices

- Online shopping reduces trips for remote workers

- Relocations mirror existing suburbanization trends, but are also restricted by employers

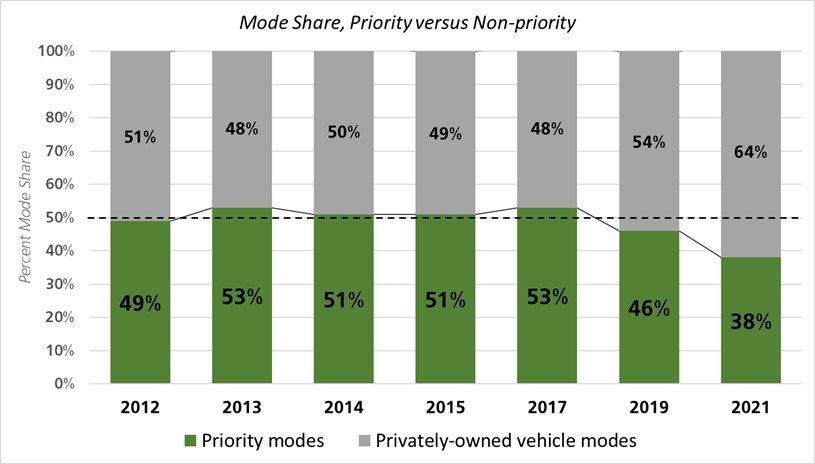

- Public transit ridership recovery will remain slow

Now returning to the original overarching research question of what the long-term impacts of remote work might be on travel behaviors, a few concluding remarks and takeaways for planning professionals can be made.

Takeaways for Planners

Prior research suggests that the pandemic will lead to sustained teleworking and that these newly remote employees are unlikely to reduce their overall vehicle miles traveled due to “rebound” effects. However, the findings from this study paint a more nuanced picture, in some ways confirming and other times countering patterns described by the literature.

Tech workers, who have effectively all gone remote for the past two years, do show strong signs that they would be eager to continue teleworking for the foreseeable future. However, their employers (along with business groups and local politicians) are putting pressure on them to come back into the office at least three days a week. This is likely suppressing some of the longer-distance relocation that would have been enabled with 100% remote work, keeping most of these employees within the San Francisco Bay Area region.

That being said, the long-term trend of suburbanization seems stronger than ever, which suggests that more of these employees will be located in neighborhoods designed for car-dependency over time. More car-based commutes should be expected from those employees who move themselves more than 5 miles away from the office.

All this does not bode well for VMT-reduction goals, especially if there is sustained reluctance to use public transit where available. This reluctance has persisted throughout the pandemic for mostly contagion-related reasons but might continue for other reasons such as concern for personal safety or system reliability, perennial problems in the San Francisco Bay Area. On the other hand, factors such as increased automobile traffic on roadways and higher gas prices may eventually tip the scales back towards public transit in the future (Chitnis 2022). Until then, transit agencies can expect depressed ridership for the foreseeable future, especially if employees stick to a schedule of no more than 3 commuting days per week.

The surprisingly rapid adoption of online shopping, particularly for food and groceries, does offer a counterbalance to potential rebound effects from teleworking. Instead of making spontaneous trips to stores and restaurants with the time saved from commuting, some tech employees seem likely to continue their habit of ordering deliveries while extending their working hours. While this may help reduce overall VMT (if delivery trips are optimized), planners should consider that the potential negative side-effects such as muted street-level activity in commercial centers and less societal interaction overall may be worse.

Study Limitations

This study was centered around a single point-in-time survey (November – December 2021) but could have revealed more insights about shifting preferences among both employees and their employers if it was conducted as a longitudinal study with multiple waves throughout 2021 and 2022. Even as the survey was being conducted and the results analyzed, employers were actively changing their “return to office” plans in response to pandemic conditions and negotiations with local politicians. Hence, survey participants may have answered quite differently if the timing of this survey was shifted even a month or so earlier or later.

The demographic profile of survey respondents matched the San Francisco Bay Area tech industry relatively accurately, but these results may not necessarily be transferrable to other regions in the United States or globally. The population of tech workers in Austin or Seattle, for example, may look quite different – and the types of employers in other regions might have different expectations or flexibility with remote work policies. Data was collected from some survey participants in other regions, but not in sufficient quantity to be statistically significant.

Certain questions in the survey were presented only conditionally based on respondents’ answers to earlier questions. This resulted in substantially lower sample sizes for some questions such as owning versus renting, home zip code, and mode choices for entertainment/medical trips.

Any analyses based on continuous variables that were converted from categorical variables (e.g., age, commute length, income) have a degree of ambiguity due to the crude methods of conversion. It was generally assumed that each category group was normally distributed (i.e., simple means were chosen for recoding) regardless of the true nature of the variable.

Future Work

This study builds upon similar research about potential post-pandemic behaviors and can subsequently be extended in the same way. Given that the effects of the COVID-19 pandemic are ongoing, likely lasting for a few more years at least, more surveys can be conducted to gauge evolving travel preferences. Such surveys can be conducted with the same audience (tech workers in the San Francisco Bay Area), a similar audience in a different geographical region, or a more generalized audience.

Future studies that repurpose survey questions used here can also begin to construct a longitudinal-like record of shifting behaviors over time. Further analysis into employer remote work policies, in particular, would be valuable as hybrid schedules are trialed and evolved given employee feedback. Interest in relocation is another facet of this study that will likely take more time to play out. It may be possible to check whether tech workers who expressed a budding interest in relocation actually follow through with their plans in a couple years’ time. Furthermore, it will likely take 2-3 more years to fully assess whether the COVID-19 pandemic fundamentally altered the industrial geography of the high-tech industry in Silicon Valley. Other “rising” tech hubs will need to have grown enough to see whether they attract significant migration from current “superstar” hubs or are drawing on an increasingly distributed network of talent throughout the United States.

Personally, I will continue to explore our existing dataset for the time being. There is still much that can be learned from this unique audience, especially with regards to relocation origins and destinations. For example, U.S. Census Bureau data can be pulled for the zip codes reported to confirm or counter respondents’ stated preferences for suburbs, single-family homes, less dense neighborhoods, etc. – which could be the inspiration for yet another paper.

Of course, if you’re a researcher who also has ideas that this dataset could help you with, feel free to reach out! While my time as a graduate student is coming to an end, my interest in academic research and eagerness to collaborate will continue. I look forward to continuing to #dothework and seeing how the research predictions play out in our cities for years to come.

Latest reporting from the San Francisco Chronicle contains findings that align fairly well with my own:

https://www.sfchronicle.com/projects/2022/sfnext-downtown/

LikeLike

The debate continues: https://www.vox.com/recode/23161501/return-to-office-remote-not-working

LikeLike

Very interesting comparison between San Francisco’s and New York’s recovery of office workers: https://www.sfchronicle.com/sf/article/sf-covid-recovery-nyc-17365339.php

LikeLike

Related to potential VMT reduction from online grocery shopping: https://usa.streetsblog.org/2023/08/23/study-grocery-delivery-may-not-reduce-driving-as-proponents-claim

LikeLike

Pingback: Publish or Perish | Brisk Mobility

Another look at how remote work does not actually lead to less vehicle usage: https://www.planetizen.com/blogs/125445-how-reduce-excess-vehicle-travel

LikeLike

Latest look at post-pandemic travel behavior has lots of mixed signals: https://www.brookings.edu/articles/with-commuting-down-cities-must-rethink-their-transportation-networks/

Conclusion is to focus more on neighborhood-scale planning.

LikeLike

A few more factoids from UC Berkeley’s Canadian Studies Program:

https://www.dropbox.com/scl/fi/2tmolhupqhv7ptekwz2e7/Remote-Work.PNG?rlkey=dtk1abq9u6p6yt78tqu8zrxoy&raw=1

The increase in VMT that comes with remote work scales with sprawling land use.

LikeLike